What is Uniswap

Everyone knows cryptocurrency is decentralized, so Uniswap provide you the platform where you can exchange decentralized cryptocurrencies.

Uniswap runs on Ethereum blockchain- WHY?

- Because Ethereum enables building and deploying smart contracts and decentralized applications (dApps) without downtime, fraud, control, or interference from a third party.

How it works

Basically Uniswap follow ERC-20 token. It provide us to swap/exchange ERC-20 tokens. Traders don’t trade directly with each other. Instead, they trade with a token pool that has both tokens reserved. This token pool is called “Liquidity Pool”. And this trading is done automatically, all is under computer program's control. They perform specific functions when certain conditions are met.

Let's discuss some key words, you may not familiar with

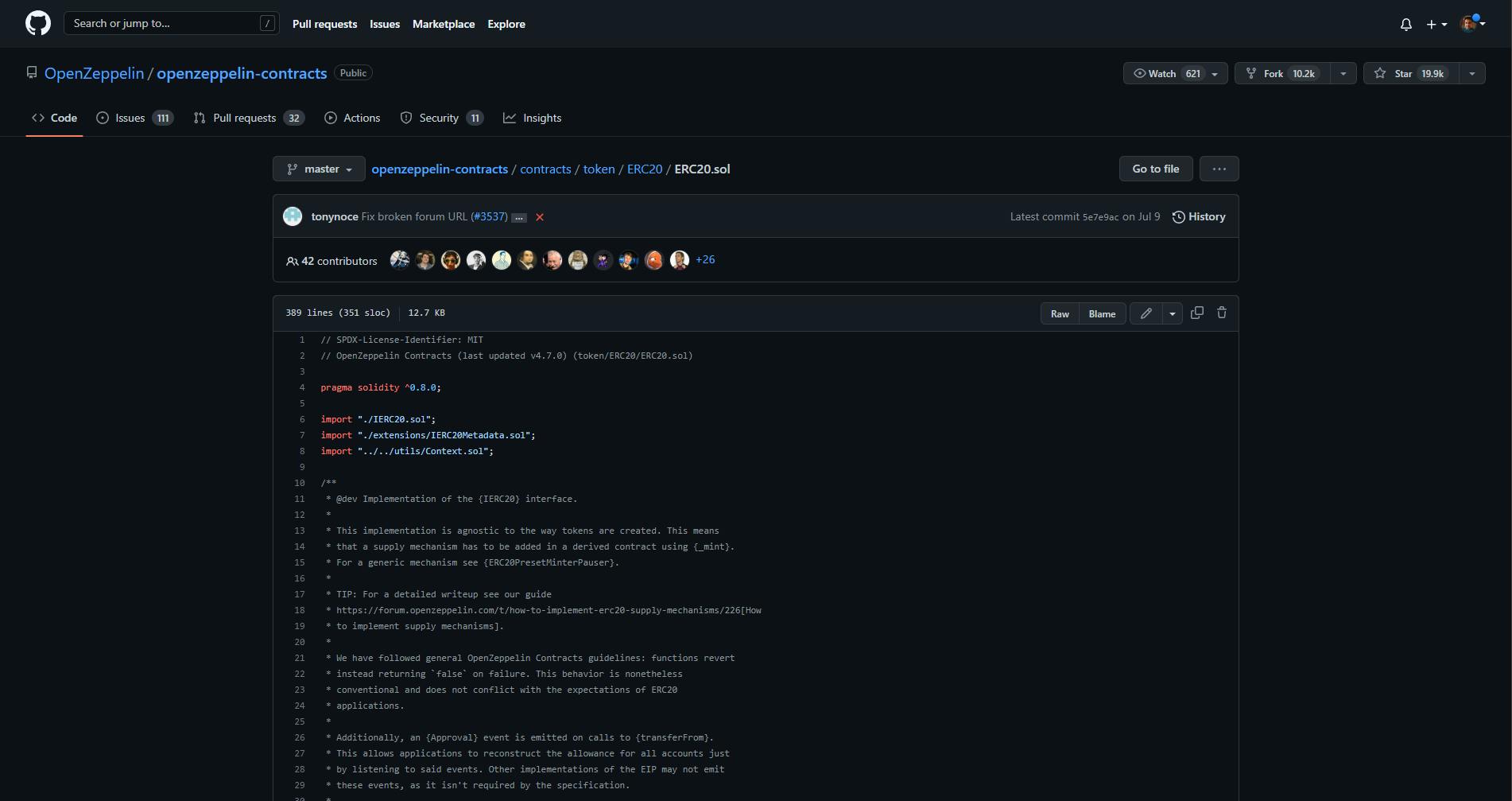

What's ERC-20 Tokens

So as I told Ethereum is not only cryptocurrency, it is a platform, above it you can run decentralized applications (dapps) can be built on top of it using smart contracts.

ERC-20 refers to a technical standard that defines a common set of rules such as how the tokens can be transferred, how transactions are approved, and the total supply of tokens. The ERC-20 standard arose from a 2015 proposal that was merged into the Ethereum protocol via an Ethereum Improvement Proposal (IEP-20).

What's Liquidity Pool

- In simple terms it is a pool where all kind of valid tokens are reserved for trade.

- Summary: A liquidity pool is a crowdsourced pool of cryptocurrencies or tokens locked in a smart contract that is used to facilitate trades between the assets on a decentralized exchange (DEX). Instead of traditional markets of buyers and sellers, many decentralized finance (DeFi) platforms use automated market makers (AMMs), which allow digital assets to be traded in an automatic and permission-less manner through the use of liquidity pools.

Is Uniswap Safe ?

SAFE?

Bruh!, Yes of course. The only thing traders afraid of is losing money by some exploits.

It's totally decentralized, more over it follows highly secured ERC-20 token rules. Wanna learn more about ERC-20 Tokens, check out the reference section. It has the same security as the Ethereum blockchain. Since it is decentralized there is no central server to hack and gain access to users’ funds.

What are Flashloans

A DeFi flash loan is a form of uncollateralized lending that works using Ethereum-based decentralized finance protocols. DeFi flash loans make use of smart contracts, which run on blockchain-enabled mechanisms that prevent funds from changing hands until certain conditions are fulfilled. In the case of a DeFi flash loan, the rule is that the borrower must repay the debt before the transaction is completed; otherwise, the smart contract reserves the payment as if it never occurred.

- 1st take out flash loan from DYDX (token 1)

- 2nd Buy token 2 on Uniswap selling token 1 (less amount)

- 3rd Sell token 2 on sushiswap buying token 1 (more amount)

- 4th Pay flash loan for token 1

- 5th Take the profit

Reference

Thankyou for your time to read this article. Resources for more depth learning are given below.

👉 How Uniswap Works, step by step